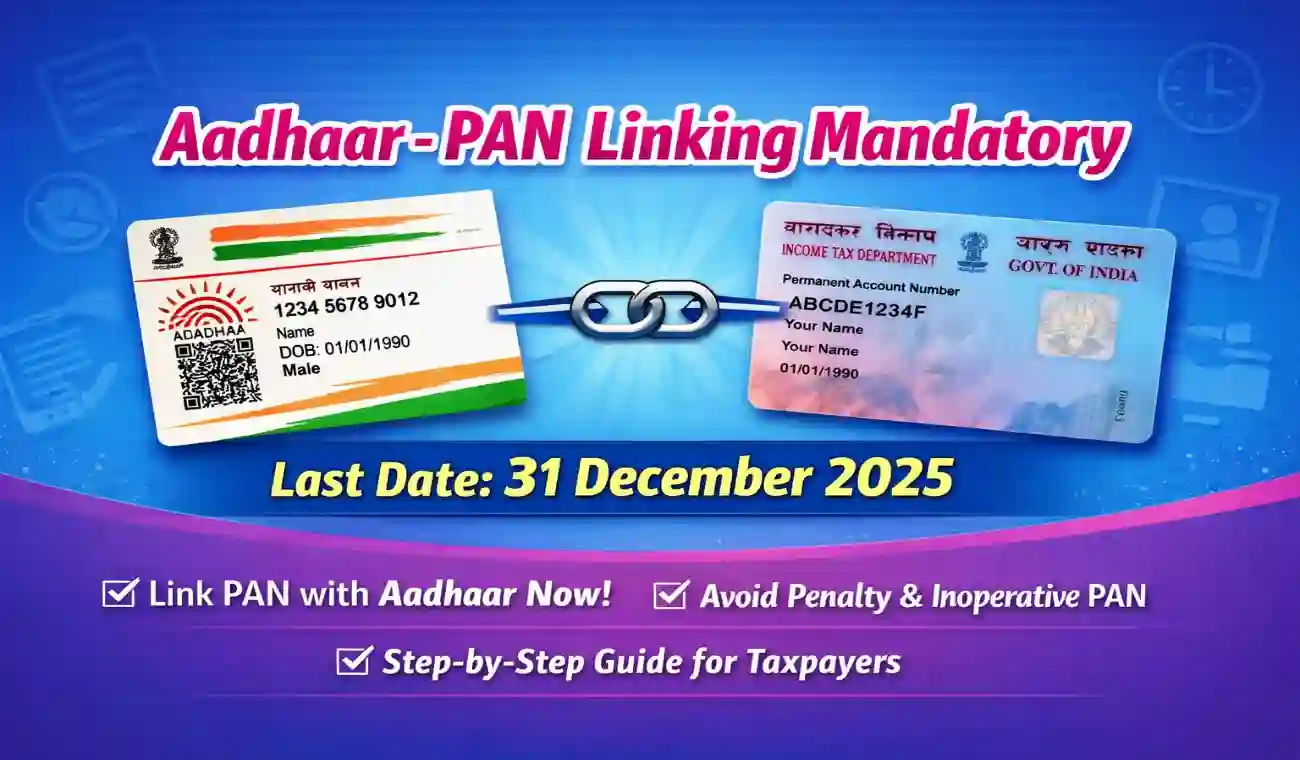

Aadhaar-PAN linking is an important compliance requirement for taxpayers because both Aadhaar and PAN are now used together for identity verification, income tax filing, banking transactions, investments, and financial documentation. As per the government guidelines, taxpayers must ensure that their Permanent Account Number (PAN) is correctly linked with their Aadhaar number before the deadline, otherwise the PAN may become inoperative and financial activities may get affected. Linking Aadhaar with PAN also helps in preventing duplicate or fake PAN cards, supports transparent tax administration, and simplifies the verification process during financial transactions. Once Aadhaar and PAN are linked, users can easily validate their identity while filing Income Tax Returns, updating KYC, opening bank accounts, investing in mutual funds, securities, and completing other compliance procedures. The linking process is simple and can be completed online using the Income Tax e-filing portal, where the taxpayer needs to enter basic details, verify OTP, and submit the request. If Aadhaar-PAN is not linked within the given deadline, the PAN card may be marked inoperative, which can cause several difficulties such as failure to file ITR, inability to receive tax refunds, difficulty in bank transactions, delay in loan processing, issues in demat account operations, and restrictions in financial verification activities. Therefore, taxpayers are advised to link their Aadhaar and PAN on time and also check the linking status regularly to avoid future inconvenience. In case there is any mismatch in Aadhaar or PAN details, such as incorrect name, date of birth, or number, the user must first update the details in Aadhaar or PAN database and then proceed with the linking process again. The government has also provided options to link Aadhaar-PAN through SMS, online portal, or authorised facilitation centres to make the process easier for users. This step has been introduced to improve accuracy of records, reduce identity-based fraud, and strengthen the digital governance system. Aadhaar-PAN linking also supports a unified identity framework that helps government authorities to track tax compliance in a secure and transparent manner. Taxpayers are advised to keep a copy of the acknowledgement or status confirmation after linking for future reference. If any user faces difficulty during the linking process, they can visit the official Income Tax portal, refer to the help section, or contact support services for assistance. Completing Aadhaar-PAN linking within the prescribed timeline ensures smooth tax filing, uninterrupted financial services, and trouble-free documentation in the future. Also Read: 8th Pay Commission: Latest News, Salary Hike, Pay Matrix & Calculator for Government Employees |

You must be logged in to post a comment.